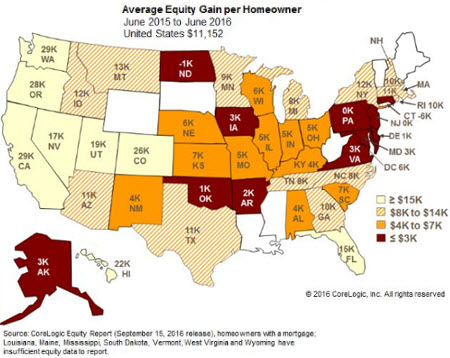

| THE RISING TIDE OF HOME EQUITY By Kendall Baer The aggregate amount of equity in U.S. residential homes has more than doubled since 2011, the result of 40 percent price appreciation nationwide during that time. Even with that much of an increase in home equity — which hit a trough of $6.1 trillion in June 2011 but by June 2016 had risen to $12.7 trillion — there is still plenty more equity to be regained while home price appreciation continues over the next year, according to CoreLogic's U.S. Economic Outlook for October 2016. "We project the national CoreLogic Home Price Index will rise another 5 percent in the coming year, helping to boost home-equity wealth by close to $1 trillion," CoreLogic Chief Economist Frank Nothaft said. "In turn, this wealth gain should add to consumption spending and contribute to economic growth in 2017." According to CoreLogic's most recent Home Equity Report released in mid-September, more than half a million (548,000) homeowners regained equity in the second quarter of 2016, bringing the total of residential homes with equity to approximately 47 million (93 percent). This left approximately 7 percent, or close to 3.6 million homeowners, in negative equity. "We see home prices rising another 5 percent in the coming year based on the latest projected national CoreLogic Home Price Index," said Anand Nallathambi, president and CEO of CoreLogic. "Assuming this growth is uniform across the U.S., that should release an additional 700,000 homeowners from the scourge of negative equity." With the substantial rise in home equity, which is a key component of household wealth, there has been a corresponding increase in consumption spending and renovation expenditures. Moody's Analytics reported that consumption spending rises by approximately $2 for every $100 worth of housing wealth that is regained. "[A] $6 trillion rise in housing wealth has lifted consumer spending by more than $100 billion during the last five years," Nothaft said. "And renovation expenditures are up as well, further contributing to economic growth." According to CoreLogic, the average gain in home equity, or household wealth, from the middle of 2015 to the middle of 2016 was $11,000 per homeowner. The largest increases were seen in California, Oregon, and Washington, all of which had an average increase in equity of almost $30,000 per homeowner. In Connecticut, New Jersey, North Dakota, and Pennsylvania, there was either a decline or no change in the average amount of equity gained per homeowner.  Kendall Baer is a Baylor University graduate with a degree in news editorial journalism and a minor in marketing. She is fluent in both English and Italian, and studied abroad in Florence, Italy. Apart from her work as a journalist, she has also managed professional associations such as Association of Corporate Counsel, Commercial Real Estate Women, American Immigration Lawyers Association, and Project Management Institute for Association Management Consultants in Houston, Texas. Born and raised in Texas, Baer now works as the online editor for DS News. Original Source: DS News |

|

|||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||