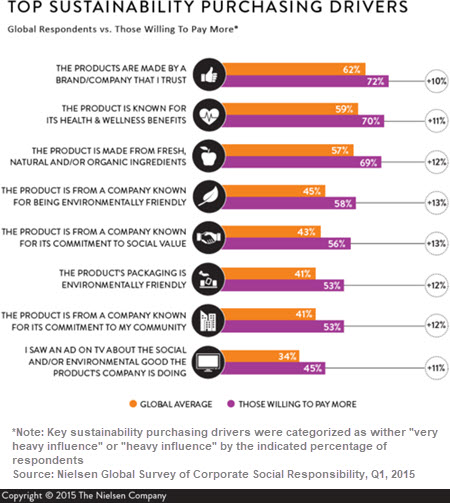

| IT'S NOT EASY BEING GREEN, BUT THE FUTURE OF REAL ESTATE WILL REQUIRE IT By Michael D. Harris Intro This article isn't going to try to convince you that humans are harming the environment. There's honestly no argument anymore so let's not play that old record because we get it. Water pollution, air pollution, deforestation, and of course, according to the band Counting Crows, our instinctive desire to pave paradise to put up a parking lot. Don't worry, there's no long "I'm better than you" speech coming. I'm assuming most of you are just like me. You recycle when you can, you shop for groceries with reusable bags, and your significant other has probably shown you a video they saw on social media that convinces you to not use straws. Sadly though, even if we all drove Teslas (I can already hear the bears rumbling about the production pipeline fallbacks) and had wind turbines in our backyards that still wouldn't be enough. Business and industries will have to have a major revamp if society can actually stop hurting the earth so drastically. Of course, the old adage of "business is only about the bottom line" comes to mind when someone suggests that companies should be more green, but I'm sorry to say, the excuses are over, and the results are in. No longer are efforts toward sustainability in spite of profits, but actually in search of them. Being green is good business. The Business Case For Sustainability Sustainability is the next step in business. Besides the fact that being sustainable companies will ensure long-term customer and resource security, there are mountains of other benefits at the corporate level for going green. In fact, by the end of the article, I hope to convince you that not only is being green good for business but for the companies that fail to go green, it will be their downfall as they are left behind by the companies willing to take the next necessary steps. I know that sounds ominous and dramatic, but the evidence is there, just keep reading. In the pursuit of profits, there's always that pesky little barrier of operating costs. Employee salaries, office supplies, legal fees, marketing costs, maintenance, utilities, and so much more. It really starts to add up as any business owner can tell you. Implementing energy saving and smart utilities or using more environmentally-friendly supplies can help cut operating costs. LED lighting, low-flow toilets/faucets, or even just reusable coffee pods for the office Keurig can go a long way in cutting costs, raising profits, and helping the earth. There are still so many other benefits to sustainability other than just overhead cost savings. According to a 2012 Deloitte real estate sustainability research report, eco-friendly office environments contribute to an increase in overall workforce productivity. Just simple things like access to natural light and environmentally friendly programs around the office can result in a more present workforce, higher sense of well-being for employees, improved employee health, and overall more satisfied employees. In fact, the research stated that cost savings related to energy-efficient utilities might actually take a backseat to the importance of improved workforce productivity in how much they benefit the overall business. Additionally, having a greener office space could help with recruitment of new workers (especially eco-conscious millennials) and retention of current workers. That's already a strong argument for going green but in a personal homage to arguably the greatest salesman of my generation, the late Billy Mays, I'm here to say, "but wait there's more"! Companies have long since realized that sustainability and green labels on their products increase the marketability and value of their brand. Even companies that once were seen as the poster children of environmental destruction, like Walmart, have pledged to go green and make moves toward environmentally friendly actions. Did the CEOs of such companies just randomly wake up one day with a life-changing epiphany? Probably not. They, as they usually do, are trying to meet the increasing consumer demand for these product and brand attributes. They are seeing how much young adults (the dedicated consumer of tomorrow) are demanding sustainability. In a 2015 Nielsen Global Survey, products from companies that are known for being environmentally sustainable and socially responsible was one of the main drivers in consumer choice and customer's willingness to pay more.  (Source: 2015 Nielsen Global Consumer Survey) Investors are also demanding businesses to do more for the environment. Some of the largest investment and retirement funds in the world like HESTA and CalPERS are focusing more and more on sustainability and environmental practices in the companies they have in their massive portfolios. In the spirit of trying not to bore you to death or mount the high-horse, below I list just a few more important business cases for going green that I haven't mentioned already:

Since going green makes good business sense, it shouldn't be hard to translate the benefits mentioned above directly to real estate. Still, there are additional benefits that real estate owners, investors, and operators can enjoy that are specific to their industry. Real estate contributes a significant impact to the environment. According to the same Deloitte research mentioned above, commercial real estate is responsible for 19% of global energy use, 40% of CO2 emissions, and 88% of the total consumption of potable water. That's pretty startling, but many leaders in the industry, along with governments, have been trying to cut down on real estate's impact. Thankfully, due to the efforts of these entities, along with engineers, architects, and everyone else who has helped in the modern design of green buildings, newer building designs have cut single building energy use in half, cut CO2emissions by a third, and cut water consumption by up to 40%. Contrary to what someone might assume, these strides in sustainable building development haven't come at a cost, they've actually come at a profit. According to research conducted by Tunbosun B. Oyedokun in 2017 through the University of Glasgow in the UK (you can view the research here) environmentally-friendly buildings, namely those with LEED or Energy Star designations, tend to benefit from a "green premium." Using a sample of Class A office buildings, the study found that those with the green designations, as opposed to their peers without the designations, saw a 6% price premium for buildings with Energy Star certifications and a 9% price premium for buildings with LEED certifications. For the market observed, this translated to an additional $30/ft2in value for Energy Star certified properties, and an additional $129/ ft2 in value for buildings with LEED certifications. In addition to the "green premium" from Oyedokun's research, on the flipside of the research in the markets studied, properties without any type of certifications or green labeling saw below market average pricing, known as a "brown discounts". As sustainable designs and green certifications become the new market norms, it will come as no surprise that properties that fail to meet the new demand from tenants will be left in the past. Green buildings also enjoyed higher occupancy rates as compared to non-green peers. Most likely due to the fact that tenants enjoy all of the benefits associated with green buildings that were mentioned in the previous section. Also, for landlords not privileged enough to have NNN lease agreements, the utility savings and lower need for maintenance comes in handy for that NOI that real estate investors care so much about. Arguably, having tenants in green buildings could make them slightly safer occupants by ensuring their employees are more productive, their brand has a stronger image, and all of the other benefits that can be enjoyed with sustainable offices which means they could be an overall stronger business. Green buildings, according to CBRE, only make up less than a fifth of the overall commercial real estate market, meaning that these properties, with all of their wonderful benefits, are in pretty high demand, so we know what that means. More demand usually translates to higher rents and rent growths. Another effort made in an attempt to meet rising tenant demand is the implementations of "green leases". Green leases, while for the most part not being legally binding, are written agreements to continue to build on the property's green features moving forward. These landlord-tenant agreements act as a stepping-stone for a lasting and beneficial relationship between both sides of the lease. Aside from positively increasing financials and meeting the growing demand from high-functioning tenants, going green in real estate helps the business in many other ways. The companies can enjoy discounts on insurance for the buildings, strengthened relations with the surrounding community, and contribute to furthering the efforts of green-labeling and certifications for future developments. Going green for real estate companies isn't just a public relations strategy, it's a truly viable business plan that will ensure the business stays competitive in the future. We're experiencing truly amazing times as investors right now. We're witnessing an extinction level event as companies come to the crossroads of whether or not to go green and to pursue sustainability measures incorporated into their business. I feel that the companies who can look past the short-term costs and can see the big picture of long-term success will be the successful and surviving companies of tomorrow. Ribbon Cutting On The US Green REIT Index Because of this strong opinion that sustainability-focused, "green" real estate companies who weave eco-friendly policies, strategies, and assets into the fabric of their business will outperform the broader market over time, I want to start tracking the performance of these companies by establishing my very own index. The index will be entirely focused on REITs that are traded on major US exchanges (NYSE, NASDAQ, etc.) and will be market cap weighted. The index will be developed over time as I find businesses that are not just meeting market standards or government mandates, but who are establishing new norms and raising the bar for the competition. Those companies who are truly ushering in a new green renaissance in business. I have decided that the first induction to my self-created "US Green REIT Index" should be none other than the company that has been integrating sustainability into the business for longer than many of its peers. A company that not only cut its carbon footprint by nearly half and has installed solar panels on a significant portion of its portfolio but has progressive and strong office sustainability programs for employees, is heavily involved in conserving the areas in which they reside, and even grow their own honey. The company I found worthy enough to cut the ribbon for my index is, drum roll please… Prologis. Prologis: A Leader In The New World Prologis has been a leader in the industry for some time now. Every year, Prologis releases a publicly available research report that showcases the company's efforts toward sustainability over the year, as well as to provide progress on the goals the company has set for itself. This kind of transparency really shows how confident the company is that it's a leader in the new age of business and how proud it is of its efforts. According to the 2017 report, some of the awards received over the course of the year are:

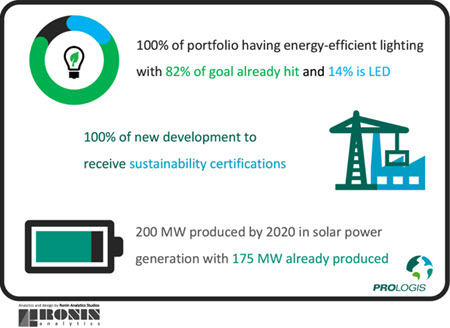

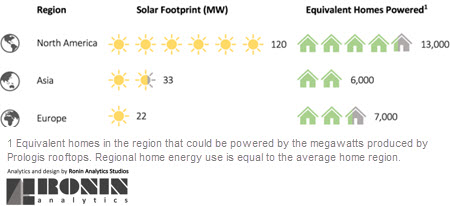

The stringent goals set forth by Prologis management have been very aggressive, but so far, the company is on track to hit all of them within the predetermined windows. Goals set forth by the company include a goal to get 100% of new development certified as sustainably built, reduce greenhouse gas emissions by over 33%, have all properties outfitted with energy-efficient lighting, produce over 200 MW per year through the solar panels installed on properties, and have cool roofs on all properties. The company hopes to accomplish all of this by 2020.  (Data from Prologis 2017 Sustainability Report) Prologis has many green lease implementations with tenants and is an industry leader by introducing energy-saving innovations into their properties like consumption monitoring and energy usage analytics, smart meters, solar panel installations on rooftops, and providing, through a third-party provider, economic analyses of the properties for the tenants to know the true impact they have on the surrounding area. The most measurable of these innovations is the solar panel installations on property rooftops. Prologis has more than doubled its solar power generation capacity since 2011 (up 113%) and generates enough energy to power 26,000 homes annually.  (Data from Prologis 2017 Sustainability Report) Prologis was one of the first in the industry to invest in solar power. In fact, the company has led the way for industrial REITs, and all REITs in general, to do more for their tenants and the environment. Because of Prologis' consistent commitment to raising the bar, they have earned the privilege to inaugurate my US Green REIT Index. I'll be looking to add more companies to the index as I find more REITs that are paving the way for future sustainability efforts and that are defining the new norms within the industry. I'm thinking that over time, as this index grows, it, and virtually all companies that are going green, will outperform as more and more investors realize that sustainability is not only good for the earth, but for their wallets. If you have any US REITs that you think should join the index, then please comment below. I will regularly update on additions and performance of the index as time goes on. As always, thank you for reading, and I hope, if you weren't already doing so, that this article will convince you to think deeper than financials and classic fundamentals for companies you want to invest in, and to also consider their sustainability efforts as an important metric going forward.  Disclosure: I am/we are long PLD. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Original Source: Seeking Alpha |

|

||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||