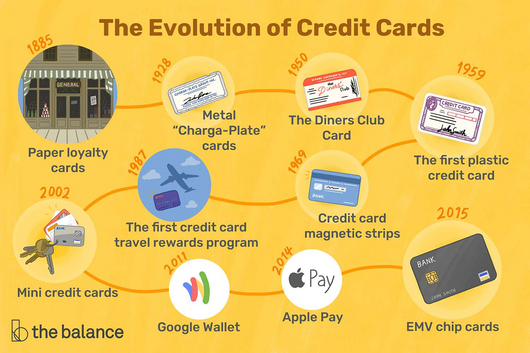

THE EVOLUTION OF CREDIT CARDS Whether using them for online shopping or in-person purchases, credit cards offer convenience and rewards with over 175 million Americans having at least one card in their wallet. Have you ever wondered how they became the norm?  ORIGINS Credit cards date back to ancient Mesopotamia, where clay tablets functioned as lines of credit. These tablets, inscribed with contracts and business information, facilitated trade and debt settlement. This system, dating back nearly 5,000 years, was among the earliest forms of credit in history. In the early 1800s, Europe saw the rise of "letters of credit," which banks issued for international trade. These letters guaranteed payment, providing a safe and standardized method of conducting transactions. This system laid the groundwork for modern credit by ensuring the bank's responsibility for unpaid debts. AMERICAN INNOVATIONS In America, the concept evolved with Western Union's "Metal Money" in 1914, a precursor to the modern credit card. The 1930s introduced the Charga-Plate, a metal card used for credit transactions in stores, which required a customer signature to process purchases. The Diner's Club Card, introduced in 1950, was the first multipurpose charge card, revolutionizing the credit landscape. American Express followed in 1958, issuing one of the first widely accepted credit cards, quickly gaining popularity due to its convenience and rewards.

TECHNOLOGICAL ADVANCES American Express introduced the first plastic card in 1959, making credit cards more durable and user-friendly. IBM's development of the magnetic stripe in the 1960s allowed for the storage of customer data and transaction history on the card itself, significantly improving the security and efficiency of credit card transactions. The introduction of EMV chip technology in 1994 marked another leap forward in security. These chips store data more securely than magnetic stripes and are tamper-proof, making them the standard for credit cards globally. Today, EMV cards often come with contactless payment options, adding to their convenience. MODERN LEGISLATION Key legislation has shaped the credit card industry to protect consumers. The Truth in Lending Act (1968) required lenders to disclose all costs associated with borrowing, promoting transparency. The Fair Credit Billing Act (1974) addressed billing errors and unfair practices, while the Equal Credit Opportunity Act (1974) prohibited discrimination in credit decisions. The Credit Card Accountability Responsibility and Disclosure Act of 2009 (CARD Act) introduced significant consumer protections, such as requiring clearer disclosures and limiting interest rate hikes without notice. These laws ensure that consumers are treated fairly and informed about their credit choices. THE FUTURE Credit cards are continually evolving with innovative features designed to enhance security and convenience. One such feature is virtual card numbers, which offer protection against fraud by providing disposable numbers for online transactions. As digital banking continues to grow, the global digital banking market is expected to expand significantly. This rapid growth indicates that credit card technology will keep advancing, offering consumers even greater convenience and security through innovations like biometric authentication, AI-driven fraud detection, and seamless integration with digital wallets. These advancements will ensure that credit cards remain a vital tool in the evolving financial landscape. |

|

||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||

:max_bytes(150000):strip_icc()/EMVWhatitMeansHowitWorksLimitations-d8a7ad6840d442aca2f674befa17526b.jpg)