|

|

WHICH GENERATION OWES THE MOST IN CREDIT CARD DEBT?

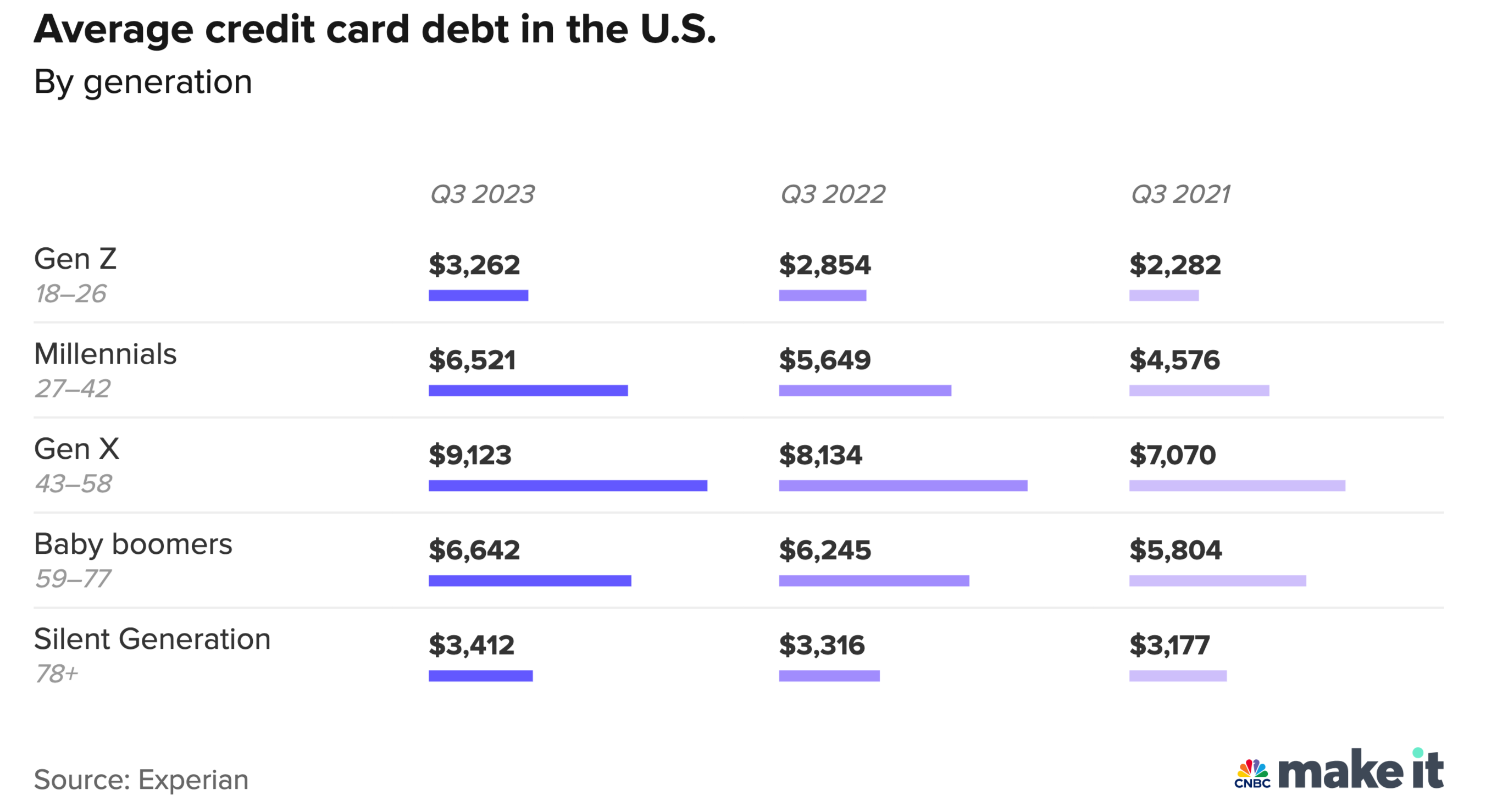

Americans collectively owe over $1 trillion in credit card debt, with one generation carrying the heaviest load: Gen X.

According to Experian’s latest data, the average credit card balance for Gen Xers (ages 43 to 58) hit $9,123 in the third quarter of 2023, marking the highest average balance of any generation. On an individual level, the overall average balance is around $6,501. Other generations' credit card debt falls closer to, or below, this average.

Here’s how the average credit card debt breaks down by age as of Q3 2023, according to Experian:

While Gen X holds the most debt, millennials’ average balances saw the biggest increase, jumping over 15% from the last quarter of 2022 to the last quarter of 2023. Gen Z isn't far behind, with balances increasing by about 14%.

Several factors contribute to rising credit card balances across generations. Higher costs of essentials like electricity, auto insurance, and heating, coupled with rising credit card interest rates, leave people with less money to pay down their debt.

HOW TO TACKLE CREDIT CARD DEBT

If you're struggling with credit card debt, start by getting a clear picture of your finances. Look at how much you owe and how much you earn each month.

“It has to start there. Once you have that, you can start to make some decisions about your income and expenses and begin to craft your approach,” says Matt Schulz, chief credit analyst at LendingTree.

Next, make a plan to tackle your debt. Here are two popular strategies:

Snowball method:

After making the minimum payments on all your cards, dedicate any extra funds to the card with the smallest balance first. As you clear the lower balances, you rack up small victories that can motivate you to continue paying down the larger ones.

Avalanche Method:

Make minimum payments on all your cards, then focus on the one with the highest interest rate. This minimizes the amount you pay in interest over time, reducing the overall amount you owe.

No matter which strategy you choose, the most important thing is to get started sooner rather than later.

|

|

|

|

|

|