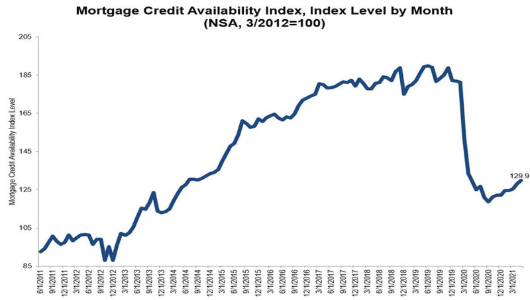

MORTGAGE CREDIT AVAILABILITY IN U.S. INCREASED IN MAY According to the Mortgage Banker's Association's latest Mortgage Credit Availability Index (MCAI), U.S. mortgage credit availability increased in May 2021. The MCAI rose by 1.4 percent to 129.9 in May. A decline in the MCAI indicates that lending standards are tightening, while increases in the index are indicative of loosening credit. The index was benchmarked to 100 in March 2012. The Conventional MCAI increased 3.5 percent, while the Government MCAI decreased by 0.3 percent. Of the component indices of the Conventional MCAI, the Jumbo MCAI increased by 5.1 percent, and the Conforming MCAI rose by 1.6 percent. "Mortgage credit availability in May increased to its highest level since near the start of the pandemic, but still remained at 2014 levels. The increase was driven by a 3 percent gain in the conventional segment of the market, with a rise in the supply of ARMs and cash-out refinances. This is consistent with the uptick in mortgage rates and a slowing refinance market, as well as MBA's Weekly Applications Survey data showing increased interest in ARMs," said Joel Kan, MBA's Associate Vice President of Economic and Industry Forecasting.  worldpropertyjournal.com Kan further commented, "The jumbo index jumped 5 percent last month, but even with increases over the past two months, the index is still around half of where it was in February 2020. A rapidly improving economy and job market has freed up jumbo credit, as banks have deposits to utilize. However, there is still plenty of restraint, as many sectors have not fully returned to pre-pandemic capacity, and there are around 2 million borrowers still in forbearance."

|

|

|||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||